In a recent report, Ark Invest has forecasted a meteoric rise for smart contract-based decentralized finance markets, projecting a staggering worth of trillions of dollars in the coming years. The investment firm’s comprehensive research report, part of its “Big Ideas 2024” annual outlook, outlines the potential of smart contracts to generate over $450 billion in annual fees by 2030, propelling the market value of smart contract platforms to a monumental $5 trillion. This monumental growth is contingent upon crypto and blockchain adoption mirroring the trajectory observed during the internet revolution.

The aftermath of the 2022 crypto contagion crisis witnessed a surge in the adoption of digital asset solutions, such as stablecoins, tokenized treasury funds, and scaling technologies, all underpinned by smart contracts. Ark Invest predicts a 32% annual growth rate in the market value associated with decentralized applications (dApps), soaring from $775 billion in 2023 to a monumental $5.2 trillion in 2030, driven by the increasing value of on-chain financial assets.

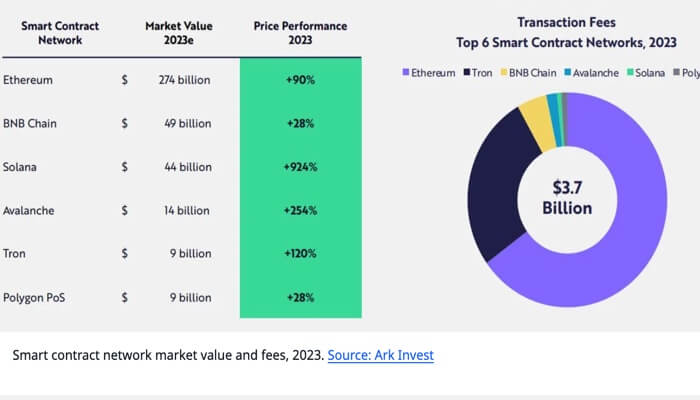

Ethereum emerges as the leading smart contract network, commanding 68.5% of the market value among the top six networks, including BNB Chain, Solana, Avalanche, Tron, and Polygon. In 2023, the collective transaction fees for these top six networks amounted to a substantial $3.7 billion. The report attributes the surge in adoption to stablecoins and the tokenization of real-world assets (RWA), fueled further by hyperinflation in emerging markets and growing global instability, which has elevated the demand for dollar-pegged stablecoins.

Ark Invest’s insights suggest that smart contracts could revolutionize the financial services landscape by significantly reducing costs. With the aggregate financial services industry currently raking in $20 trillion in total annual revenue, smart contracts have the potential to materially lower the industry’s take rate, which currently stands at 3.3% relative to the value of all financial assets. The report concludes by emphasizing the transformative power of smart contracts in facilitating the origination, ownership, and management of on-chain assets at a fraction of traditional financial costs.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Litecoin

Litecoin  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Uniswap

Uniswap  Polkadot

Polkadot  Solana

Solana